Memo Published January 29, 2026 · 5 minute read

The Business Opportunity Blueprint: A Framework for the New Economy

Imani Augustus

Small businesses have been in survival mode for years. One crisis bled into the next—supply chains snapped, prices soared, workers disappeared. The strain on American entrepreneurs has reshaped local economies and put the promise of the middle class at risk. Yet in Washington, leadership faltered. Lawmakers focused elsewhere, partisanship hardened into paralysis, and small businesses were too often left without real, lasting champions.

This must change.

Entrepreneurship is essential for wealth building, both for families and communities. And there is a clear role for government to ensure everyone in America has an opportunity to build generational wealth and financial stability through business ownership. That’s why we are introducing the Business Opportunity Blueprint. This initiative calls on lawmakers to take a stand, show up visibly, and unite with a community of advocates to advance a pragmatic agenda for small business. It will offer a policy platform that prioritizes a long-term path to growth for businesses at every stage. And it will bring together a coalition of advocates and leaders to offer guidance and amplification throughout the way.

The Invisible Crisis on Main Street

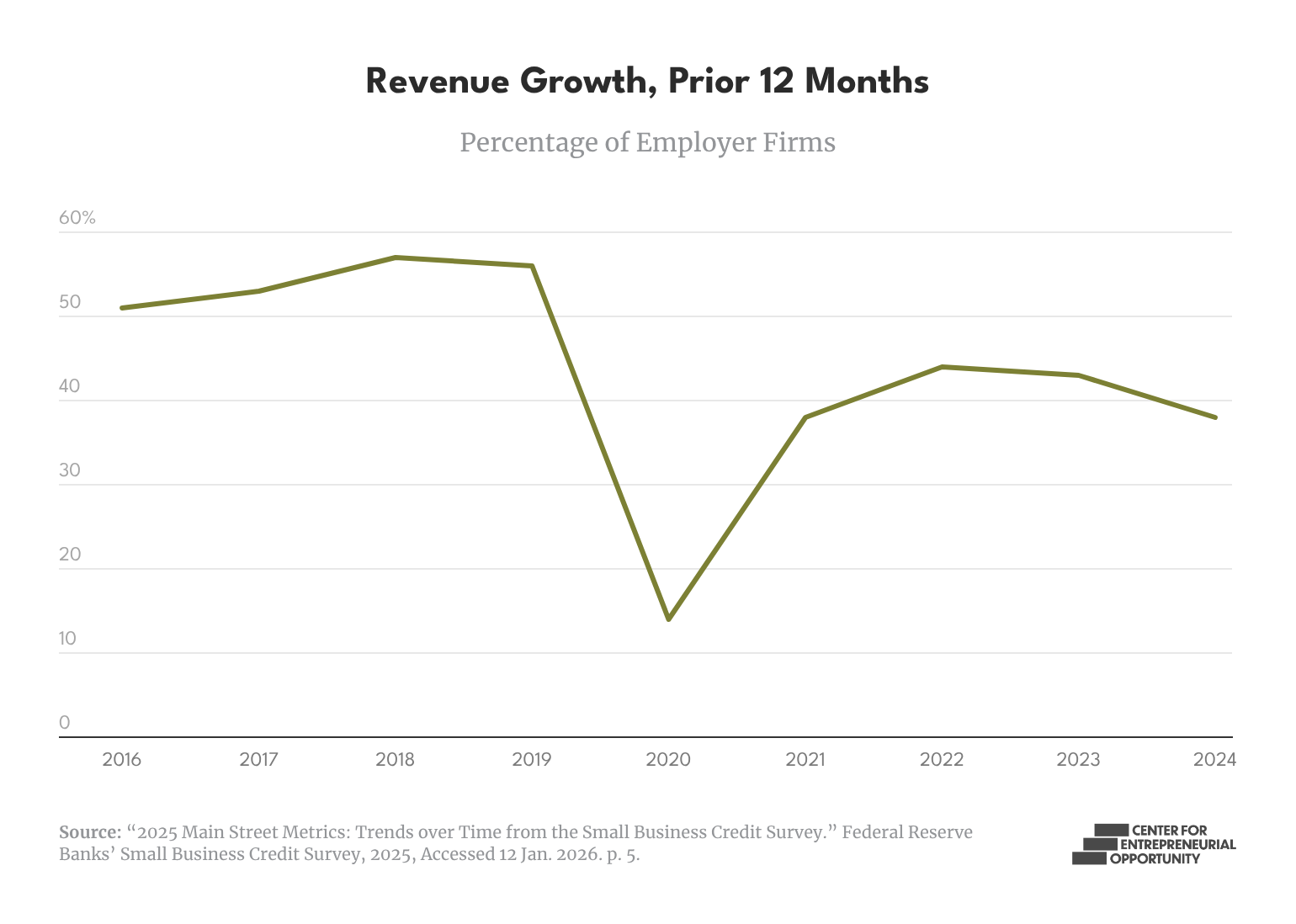

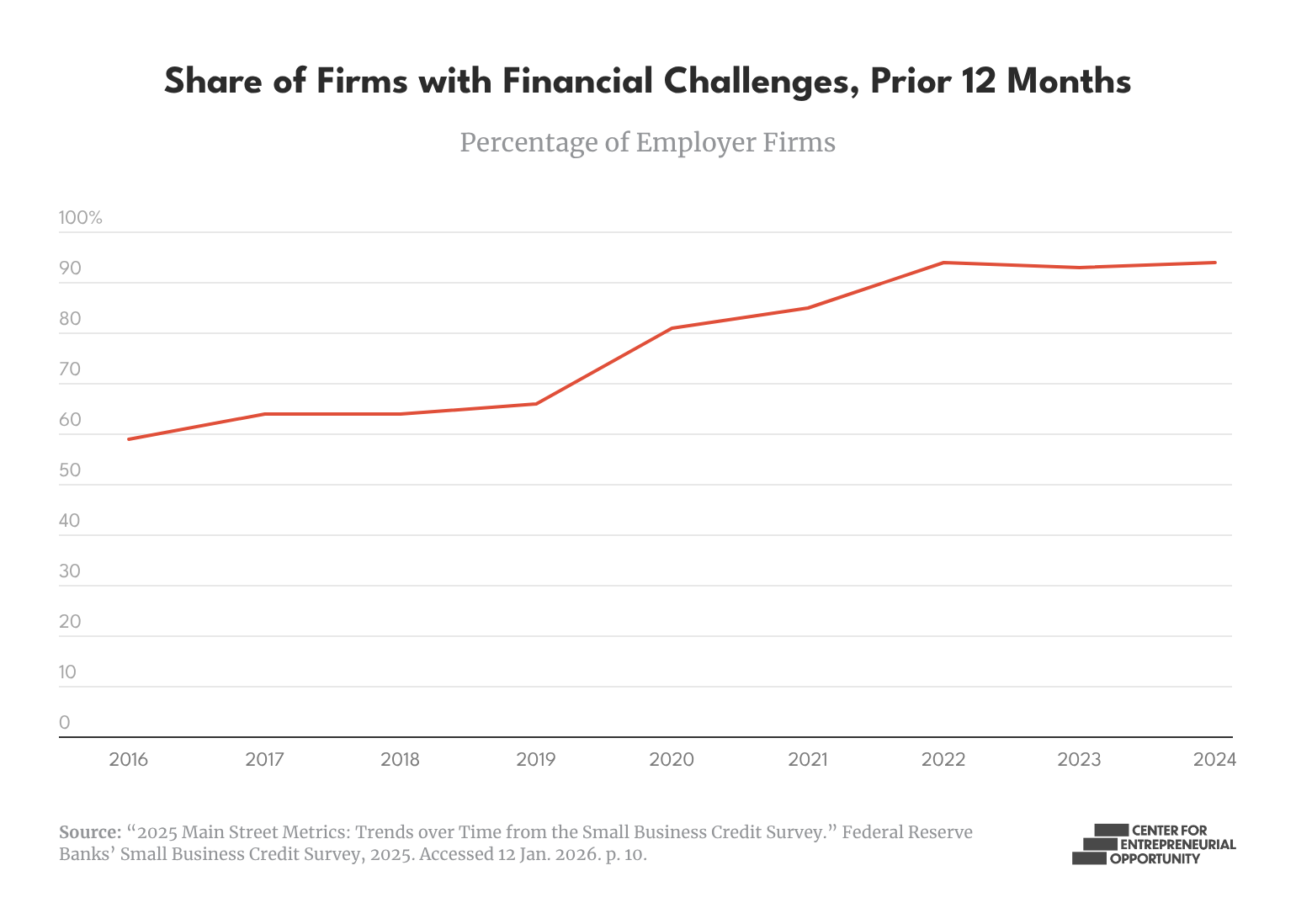

While Washington heaps platitudes on Main Street, the economic reality for entrepreneurs is dire. Revenue for employer firms reversed its post-pandemic upward trend, with just 38% reporting an increase in revenue from last year.1 Fewer businesses report hiring more workers than in 2024.2 And firms reporting financial challenges like weak sales, debt repayment, and credit availability reached and all time high of 94%.3

It’s no wonder that entrepreneurs feel increasingly unsupported. Ninety-four percent of voters believe access to starting a business is essential to our nation’s future, yet 92% say it has become difficult or nearly impossible to do so.4 Seventy-four percent of business owners think that Washington cares more about large corporations than about them.5

More than half of US counties saw a net loss of businesses between 2000 and 2022. During the same time, the states of Illinois, Indiana, Iowa, Michigan, Missouri, Ohio, Pennsylvania, and Wisconsin together added fewer new firms than Brooklyn.6

Businesses owned by minorities, in particular Black-owned businesses, are as likely to apply for financing as their white counterparts but are more than twice as likely to be denied.7 Financial volatility has prompted banking institutions to tighten lending requirements, restricting access to affordable credit.8 Regulatory requirements have grown more complex, and the public procurement process increasingly favors larger, well-resourced vendors—even as total federal spending to small businesses has risen.9

Why Policymakers Must Act Now

There are 435 Members of Congress and 100 Senators. Ask any of them, and they will undoubtably tell you that they support American entrepreneurs and small businesses. But tepid support doesn’t translate to real, lasting change. Too much lawmaking is reactive—allowing vital programs to approach expiration rather than proactively improving policy.10 In other instances, there is a lack of imagination about how to leverage government to expand entrepreneurial opportunity. The result? This inaction erodes entrepreneurship as a wealth-building pathway for the middle class, slows job growth, and risks letting US innovation lag behind our global competitors.11

Policymakers must not only demonstrate that they understand the scale of the small business crisis—they must also demonstrate that they are prepared to act. No economic agenda is complete without a robust push to make starting and scaling businesses easier for more people.

Introducing the Business Opportunity Blueprint

That is why the Center for Entrepreneurial Opportunity is launching the Business Opportunity Blueprint. The Blueprint will serve as a challenge to lawmakers—urging them to champion tangible changes that small businesses need. The Blueprint consists of three components:

- A congressional challenge to encourage policymakers to visibly advocate for small businesses. We’ll identify, support, and uplift lawmakers who want to be serious about convening, championing, and amplifying business ownership as a pathway to wealth and community stability.

- A policy platform that prioritizes a sustainable long-term path to growth for businesses at every stage, rather than bursts of support for startups. The platform will include reforms to expand affordable capital, streamline procurement processes, and strengthen entrepreneurial ecosystems.

- A broad coalition of owners, advocates, ecosystem leaders, and industry groups to align on shared principles and amplify stories into national priorities.

Conclusion

If current economic headwinds persist, more small businesses will close, hollowing out Main Streets, weakening local job creation, and undermining any credible plan to make middle‑class life affordable and secure. The Business Opportunity Blueprint is a challenge to lawmakers—pushing them to champion small business vitality as a core component of economic opportunity. Policymakers can prove they are champions of entrepreneurial opportunity in every community—urban, suburban, and rural alike—redefining the nation’s economic narrative around fairness, mobility, and shared prosperity.